Welcome to the first in a series of articles that will examine and make a bullish argument for each of Aladdin DAO’s protocols: Concentrator, CLever, f(x) Protocol, and finally, Aladdin DAO itself. It is my hope that these articles educate defi participants on the very grand vision that Aladdin DAO has put into motion. In each article, I aim to lay out in detail how each of these protocols functions, why they are unique, and how they each will be instrumental in Aladdin realizing its expansive vision to be at the very center of global finance.

Let us now set our sights on revealing the layers of design and insights that can be found within Aladdin’s universal perpetual motion machine: Concentrator!

The Beverly Clock

Despite many attempts, and many claims, of having built a perpetual motion machine, no one has, for one very simple reason. They are impossible.

Not impossible however, is a device which uses available energy, solar or water for example, to do its work for it. Not so much a perpetual motion device, as just a very efficient (or should you be feeling judgmental, lazy) machine.

Such is the Beverly Clock, a clock invented in 1864 by Arthur Beverly and located in the foyer of the Department of Physics at the University of Otago in Dunedin, New Zealand. Run on atmospheric pressure and changes in the temperature, an airtight box inside the clock expands and contracts throughout the day pushing on a diaphragm. It takes only a six-degree Celsius temperature variation over a day to raise a one-pound weight an inch. This in turn descends, powering the clock.

Despite this, because the mechanism continues to function, the Beverly clock is considered one of the world’s longest running experiments, and is the closest anyone will ever see to a “perpetual motion machine.

As simple yield farmers on mainnet, we do not want to spend our days toiling in the bowels of esoteric protocols to accrue a smattering of tokenized dust that will cost us a fortune to swap. We, the gigabrain farmers of Ethereum mainnet, want something better. We want the ideal yield farming tool: We want to hold all of our liquid value in an LP, and then farm a yield that is not only of another singular position, but automatically reinvests it back into that desired yield source. Oh to march out of the past and into the future: we seek the modern perpetual yield farming machine! Well, with Concentrator, Aladdin DAO has developed their own universal perpetual yield farming machine!

WHAT IS CONCENTRATOR

To Farm and To Hold

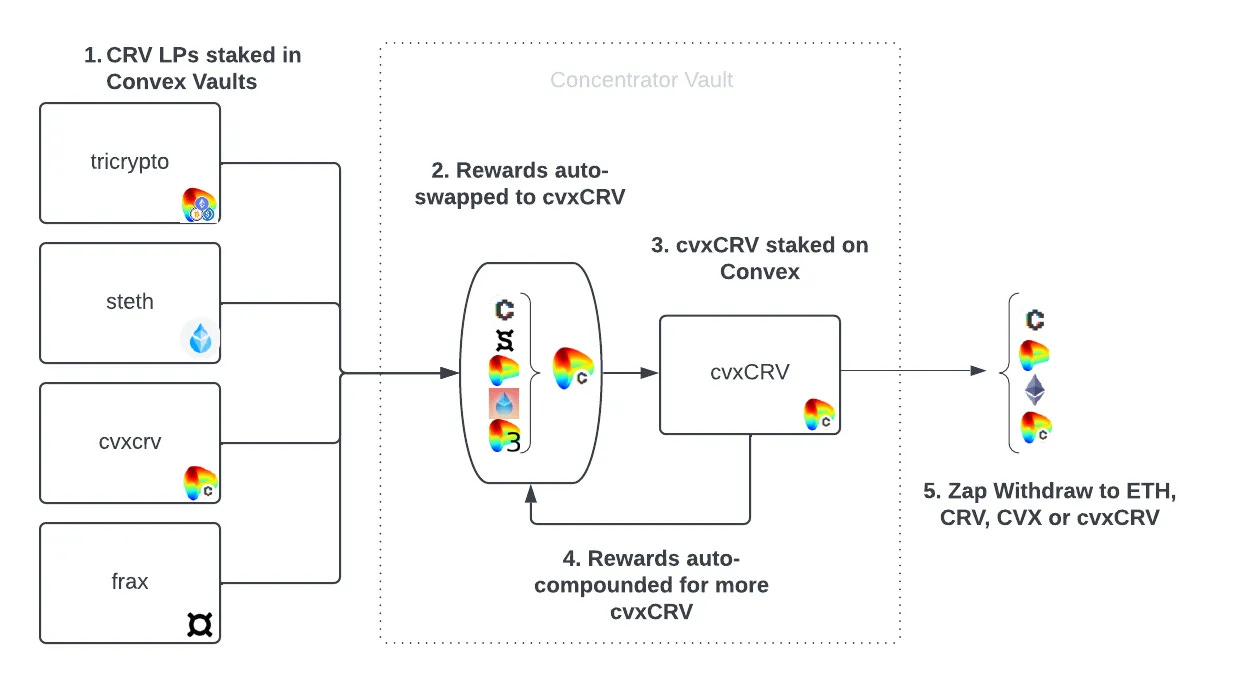

Concentrator is an entirely new type of auto-compounding vault system, based on a philosophy of farm-and-hold. Rather than selling rewards constantly and buying more of the deposited token, Concentrator helps farmers concentrate yields from multiple Convex vaults into cvxCRV, then leverages auto-compounding to grow those returns even more. When it’s time to withdraw, users can choose from cvxCRV, CRV, CVX or ETH.

Why farm & hold? The typical auto-compounder principle of farm-and-dump, or immediately selling earned reward tokens, is not wise in all cases. Imagine earning Bitcoin as a reward in 2010, and selling it all immediately to buy USD! For the best protocols of today, which will grow to become foundational building blocks of DeFi tomorrow, dumping their tokens now could end up looking just as foolish. Smart farmers use diverse core assets to farm the highest quality DeFi tokens, holding them with conviction, and Concentrator helps them do that with much better returns and much less hassle.

As you can see from the diagram and the excerpt from the article above, at its heart, Concentrator is quite simple. Hold an LP, gain rewards of a blue chip yield bearing asset. That’s it. It works just like any other autocompounder except your rewards compound into another strategy rather than the LP you are holding. Concentrator launched in March of 2022 and at its peak had a TVL surpassing $200 Million. Currently, the protocol has approximately $63 million in TVL, $47 MM of which are in the base LPs, called Harvesters, and $16 MM are in the autocompounding yield bearing vaults, called Compounders. Concentrator has achieved remarkable product fit in defi, and has been a robust and secure protocol from inception. Every strategy has been audited, as Aladdin does not roll out ANY new code without a thorough audit. To say that Concentrator has been successful would be an understatement, as it launched in the beginning of a bear market and has seen its strategies grow and mature ever since inception.

WHAT MAKES CONCENTRATOR SPECIAL

DeFi’s Perpetual Motion Recycling Machine

Let’s take a look at how most autocompounder’s work:

As you can see, most autocompounder’s work via a strategy called “farm and dump ''. This means that you take your desired LP position, place it in a vault, and then the vault collects those rewards and then swaps them for more tokens in your own underlying position. It is constantly selling the reward tokens, and constantly buying the tokens you already hold. This is great for you, but absolutely terrible for the protocol who’s reward token you are farming and dumping. This method of auto-compounding is very scorched earth and is a negative-sum addition to defi.

Now let’s take a look at how Concentrator works:

Here, you notice right away the similarities from the previous example. You place an LP in a vault, it gets rewards, and those rewards are then sent off to a DEX (in the case of Concentrator, Curve). But here is where things get really interesting. While it does swap out the rewards you were farming, it also buys them back, either directly or indirectly, in a different strategy. You might be farming tricrypto into aCRV (autocompounding cvxCRV). What is happening underneath the hood is that your original CVX and CRV rewards are being swapped for cvxcrv which is being placed into Convex’s cvxCRV staking vault. This is actually beneficial to Convex, as you are indirectly buying back the CRV in the derivative format of cvxCRV! This actually gets even more positive sum as another strategy may be farming staked CVX, which is buying back the CVX that the other vault was dumping!

In essence, Concentrator is actually an industrial recycling plant that is rebuying the rewards it was dumping previously. And it is doing this 24 hours a day, 365 days a year. Constantly selling, constantly rebuying and creating value for everyone participating in the system. For Curve, Convex, and StakeDAO: Concentrator is the first perpetual motion machine ever created.

The Razor's Edge

“If there is a decent amount of money to be made from an asset, then there is an immense amount of money to be made from a synthetic derivative of that asset.”

Kmets’ DeFi Razor

On December 17, 2020, Lido launched their stETH liquid staked Ethereum derivative. As we all know by now, this token was created to allow users to take a liquid position in the underlying locked Ethereum in the protocol’s staking contract. To say that this had positive effects in defi would arguably be the understatement of the decade. Lido’s stETH token is now the largest staking provider to the Ethereum beacon chain, and is so massive that its very existence poses existential issues for Ethereum itself. But how and why did it get so large? Essentially, it solved the key problem with staking: I want to stake my ETH and farm ETH, but I also want to be able to do so while staying liquid, and using these tokens in various other ways, such as for LPing, for collateral in CDPs and lending, etc.. stETH solved a massive need, and it proved to be so powerful and desired that it now makes up nearly 33% of the total amount of ETH staked in the consensus staking contract.

https://dune.com/hildobby/eth2-staking

If you haven’t noticed by now, Curve itself functions alot like a proof-of-stake Layer 1 blockchain. User’s can stake their liquidity, and then earn the base token, CRV, which can be locked as well to earn the protocol fees, boost CRV emissions, and allow for governance power of the protocol. The CRV emissions incentivize the functioning of the entire system, and by locking (staking) CRV, the veCRV essentially acts as a consensus mechanism for further continued successful operation of the protocol. Convex realized VERY early on that creating liquid positions for veCRV, via cvxCRV, would be extremely valuable in defi. And so the Curve wars began, with Yearn and StakeDAO competing to lockup CRV and create these liquid, stakable derivatives.

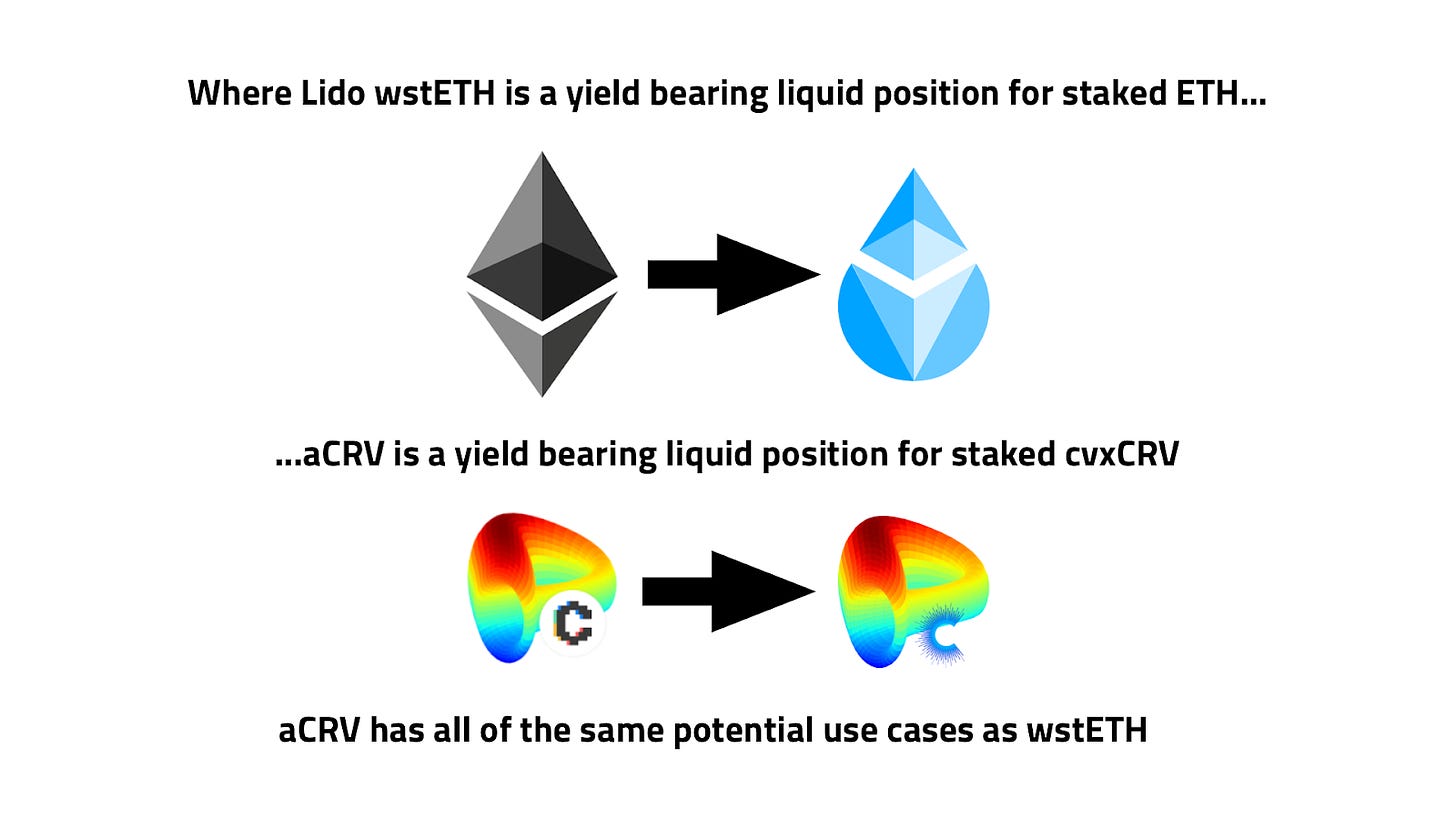

Because of Concentrator’s special ability to allow users to hold one asset and farm another, the vault system allows for users to auto compound into yield bearing vaults separate from their harvesting vaults. These are the compounders, and each compounder has a strategy that autocompounds the rewards for each harvester vault. aCRV is a compounder that at least a dozen harvester vaults compound rewards into. As we stated earlier, the aCRV vault under its hood is actually just cvxCRV staked on Convex earning the native rewards from that vault. But aCRV the token is actually an ERC-20 tokenized share of the whole vault. It is indexed, and so aCRV tokens act exactly the same as wstETH tokens. Whatever wstETH can do in defi, the same is possible for aCRV, or asdCRV, or aFXS, or ANY of the compounders!

In essence, Concentrator created LSDs for the entire Curve ecosystem. If you are bullish on Ethereum LSDs in defi, then being bullish on concentrator’s compounder aTokens is completely justified. The AladdinDAO team is constantly looking for more opportunities to integrate the tokens into defi. Wen aCRV or asdCRV or aCVX as in new strategies? SOON(™)

CONCENTRATOR’S DESTINY

Concentrator has so far been AladdinDAO’s most successful protocol by an order of magnitude. The immediate simplicity and usefulness of the protocol has been evident to many Curve ecosystem users. Concentrator’s destiny is to become the ultimate protocol for users and protocol’s to farm their liquidity. As you can see below, the protocol’s governance token CTR, of which all 5,000,000 have been issued, is SEVERELY misvalued by the defi marketplace.

If Curve is to become the ultimate liquidity marketplace for defi, then Concentrator is a leveraged position on top of that to ensure that not only is your liquidity well utilized, but also beneficial for all of the liquidity holders! Concentrator will eventually have dozens of compounders and hundreds of harvesters, all of which can be utilized throughout defi for a myriad of use cases. Additionally, you should pay very close attention to Concentrator should Curve start to allow LPs to be utilized for crvUSD collateral. 👀

To sum this all up, Concentrator is an autocompounding protocol designed to allow LP holders to hold the assets they want, and farm the assets that are desirable in defi. It is always in a perpetual feedback loop of selling assets for one strategy and directly or indirectly buying them back for another. The assets created from the Concentrator protocol, the aTokens, are essentially yield bearing positions, rooted in the Curve ecosystem, that can be utilized in defi just like any other position that an Ethereum LSD might. Concentrator has yet to be recognized in defi as the superior liquidity management engine that it is, as evidenced by the severe undervaluation of its governance token CTR. While we wait for the market to wake up and recognize the power of Concentrator and what it brings to defi, the protocol will be doing what it always quietly and effortlessly does: perpetually allowing users to farm and hold without any user input, recycling farming tokens, and constantly providing fees to veCTR holders. The universal perpetual machine that is Concentrator is ready for billions of dollars of TVL to flow in…are you ready?

“I am bullish on Concentrator.” - Kmets